We recently announced our $95M D round led by Generation Investment Management (Generation). As you can imagine, raising such a large round in one of the most difficult markets in the history of tech, was an intense process. Like every intense process, it generated many learnings and unique insights. My goal is to share them in this blog post. I will cover why we decided to raise, the behind the scene fundraising journey, why we decided to partner with Generation, and our perspective on the AI and drug discovery market.

What changed since our last round and why we decided to raise?

Our last fundraising round was in November 2021, when the market was at an all-time high. We raised a $50M C round that was co-led by TCV and iNovia. With a team of around 200, we were rapidly gaining market traction with our AI-Assisted Reagent Selection Platform and working with Amgen and several large pharmaceutical industry leaders in stealth mode on ASCEND, the world’s first Enterprise AI Platform for Life Sciences R&D.

In the 15 months between our rounds, we transitioned from a startup to a scale-up. We experienced our most intense period of growth. We tripled our revenue, doubled our team size from 200 to over 400, and officially launched our new platform ASCEND. Today, 16 of the top 20 pharma companies are leveraging the ASCEND platform to accelerate their research. Customers like Novartis shared the impact we made on their R&D organization in their yearly report (see below).

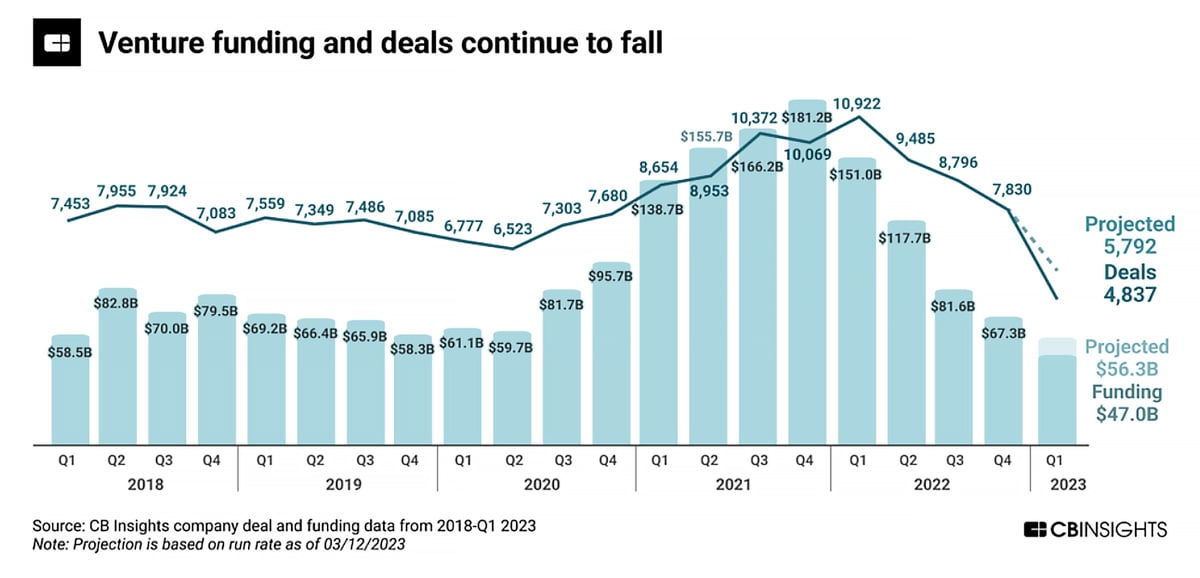

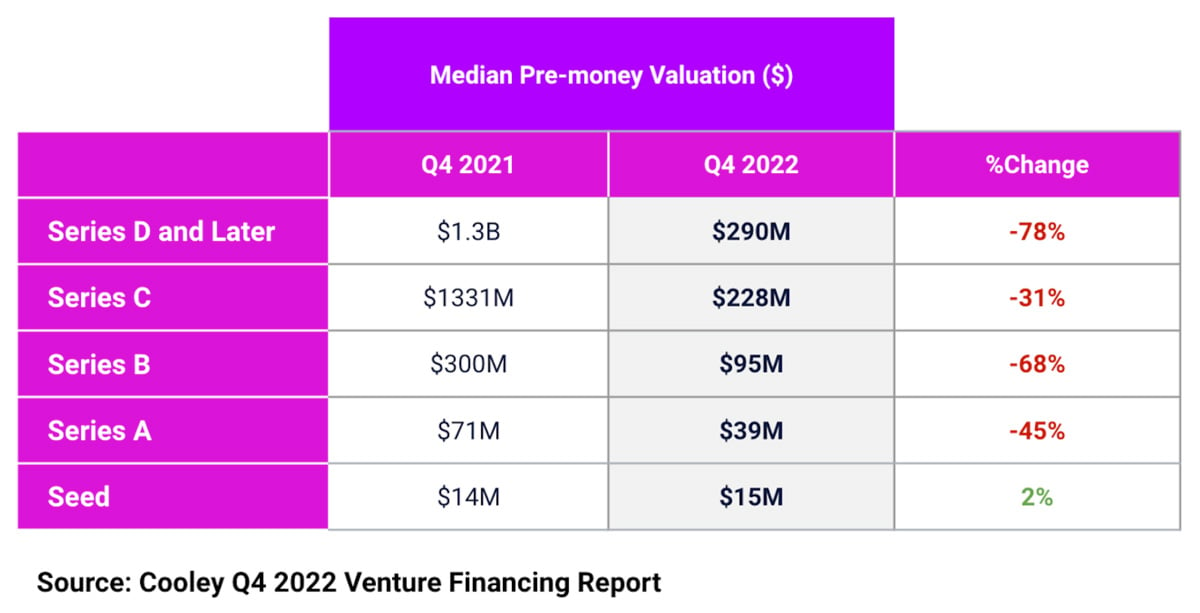

While we were experiencing positive growth, the exact opposite was happening in the tech and biotech market. The market cap of leading public tech companies decreased by 80%, valuations of late-stage private companies were being cut by 30%-70% from their 2021 glory days, biotech companies were trading for less than their cash position, and many pharma companies were pushing to reduce cost and spend.

It was clear to me that there is a significant chance that the macroeconomic environment will make things take longer, more expensive, and overall harder in ways we can't yet predict. In addition, my sense and the advice from our investors was that this is just the beginning of the economic downturn in tech and biotech and we should expect it to last for a few years. One banker told me “it was a great party and the hangover will last for years”.

I believe that momentum is very hard to gain and very easy to lose and since we have such strong momentum, the last thing we want to do is slow down or limit our long-term investments due to macroeconomic circumstances. Having an extremely strong cash position during times of macroeconomic uncertainty is particularly valuable as it gives one the ability to continue making smart long-term decisions while taking advantage of the economic turn that is negatively impacting other players in the market.

So, I decided to follow my fundraising philosophy which is to raise when you don't need to raise and when you have a good story to tell. This philosophy is rooted in advice my dad gave me when I was younger, “when you don’t need money people will give it to you, but when you need it, they won’t”.

The fundraising journey

I have a very unorthodox method and perspective on fundraising. I don’t talk to investors between rounds, I don’t build relationships, and instead of creating a three to nine-month fundraising process, I do it very intensely over a 3-week period. I have done eight fundraising rounds so far and have raised over $200M. I learned from experience that this is how you maximize the outcome of the round while investing the minimum amount of time. Given that fundraising is extremely distracting and time-consuming, this is a good formula.

My experience shows that eight qualified investor meetings typically lead to one offer (term sheet). Usually, we engage up to 15 investors over the course of three weeks to get three offers. Given the advice we got from our investors on how bad the market is and how their portfolio companies are struggling to raise, we decided to triple the number of investors we typically engage with. As you can imagine, engaging with 45 investors over the course of three weeks was very intense. My CFO and I worked 20 hours a day but it was worth it as we got multiple offers, a great valuation, clean terms, a tier one partner, and went from first meeting to term sheet in only three weeks. This fundraising experience generated a lot of insights. Here are the main ones:

- You can run a fundraising process on Zoom - Covid really changed the fundraising process. Pre-COVID, I would have to be on the road for 3.5 weeks. Post-COVID, I ran the entire process on Zoom from my office, and investors who were interested, flew in for the day to meet us.

- Investors will dig in but won’t invest - what I noticed during this process is that the entire funnel has morphed. Usually, most investors will pass after the first meeting (50%-80%) but the ones who do dig in are 80% likely to give you a term sheet. This time, 80% of investors wanted to learn more after the initial call and all of them conducted full due diligence (a very intense process over the course of two weeks). However, instead of 80% of investors converting to a term sheet, only 20% of them did. This was very surprising to me and I couldn’t wrap my head around it until one of our board members explained it to me, “Liran, investors are not investing now and most of the deals are bad, investors just have more time, and if a good deal comes across they will put in the time.” I think this is a very important insight for those who are fundraising right now. More investors will dig in but it does not mean they will invest.

- Investors want proof of success - the type of profile investors are looking for is very different from 2021. While many were more willing to place large bets on high-risk companies, investors are now looking for companies that can tangibly show their vision and evidence of past execution.

- Valuations are a sticking point - almost all the investors that passed on investing in us did so because of the high valuation we and every other company got in 2021. Investors are looking to get a 30%-70% discount on the 2021 price. Since we tripled our revenue and were already working with the majority of top pharma companies, those bad terms did not apply to us.

- It is hard, very hard - before going out to raise, my board warned that the market is very hard. Unfortunately, they were right. Having SVB collapse and Chat GPT released in the middle of the round did not make things easier. In fact, I believe the market is worse now than it was in March when we got our term sheet.

While we ran a great fundraising process, this is by far the hardest process I ran. The decision to triple the number of investors we engaged was the right one.

Why we partnered with Generation

While we got multiple offers, going with Generation was a no brainer for us. This is for two simple reasons:

Market thesis - We have a very unique thesis about the preclinical R&D market that we share with Generation. In the last two to three decades, the commercialization level of internal R&D drug discovery has been extremely low while R&D costs increased by 6X. This is of course unsustainable. At the same time, pharma cannot halt internal R&D for three main reasons:

- It will be culturally jarring. What will life science companies do?

- Internal R&D provides pharma the due diligence muscle to evaluate potential candidates

- The right biotech asset might not always be available at a reasonable price

We believe that one of the key reasons R&D productivity is declining is that, unlike other industries, scientists within preclinical R&D are underserved in terms of software tools. An enterprise AI solution that is focused on unraveling biology can finally enable a new breadth of software that can transform R&D productivity.

Sustainability - one of our guiding principles at BenchSci is, Success Beyond Success. When we learned about Generations’ sustainable investment thesis, it became a no-brainer for us.

They are committed to taking a comprehensive approach to analyze significant shifts in the industry and identify the elements that drive a more sustainable future. Generation acknowledges that human health is influenced by various factors beyond medicine, such as social determinants, preventative behavior, and care delivery. While recognizing the critical role of these factors, they also understand that drugs often serve as the last line of defense for patients and will continue to be a vital component of healthcare. From Generation's perspective, AI solutions that expedite drug development are seen as integral to achieving a sustainable solution. This shared vision aligns BenchSci's focus on leveraging AI technology to enhance drug discovery with Generation's commitment to a holistic approach to healthcare. You can read more about Generation’s perspective of the Revolution in a Petri Dish: Sustainability in Life Sciences.

Learnings, conclusions, and the look ahead

In this final section, I would like to share what I have learned from scaling a company in the AI and drug discovery space for the last eight years.

- It takes a decade - modern AI was invented in 2012, at the University of Toronto. Since then hundreds of billions of dollars have been invested in AI startups and internal enterprise initiatives. Looking at other technological breakthroughs in the past, AI within big pharma is no different. The transition from a research paper to a scalable technology that makes an impact and one that pharma is willing to buy takes a decade. I am very excited that we are now seeing the real impact AI can make and the fact that more and more pharma are identifying AI as a core capability within R&D.

- There are two types of offerings - it is very clear to me that there are two distinct offerings in the AI and drug discovery market: the first is companies who have built an AI-first biotech. These companies either develop their own drugs, partner with pharma on royalty-type deals to co-develop drugs, or do a combination of both. This offering doesn't scale across the R&D portfolio and is for specific indications. These companies both partner and compete with pharma.

The second type of offering, where BenchSci sits, is SaaS companies that developed an AI software platform for pharma to use at scale across their R&D organizations. These companies are productizing and democratizing AI for the market. The goal of these companies is to take important scientific workflows and dramatically improve them by putting AI software in the hands of scientists. For example, improving clinical trial design and patient selection, hypothesis generation, target selection, experimental design, and more. - There are three types of players - while there are two types of offerings, there are three types of players: AI biotech companies, software providers (BenchSci), and internal initiatives within pharma companies. It is very clear that pharma companies are embracing AI and are building internal teams to either develop their own capabilities and/or evaluate different partnerships.

- AI has moved up stream from Clinical to preclinical - when we started commercializing our technology 5 years ago, no one in the pharma market was investing in AI in the preclinical space. The majority of pharma were trying to apply AI to the vast amount of clinical data they have to improve patient stratification. Today we see more and more pharma investing in applying AI to unravel the complexity in the preclinical space. Companies like GSK, Pfizer, and Abbvie, have publicly announced the formation of big teams to develop internal AI capabilities in preclinical R&D.

- Build vs Buy - I think the preclinical pharma market has a tendency to build more than buy and that it is related to the lack of sufficient software solutions in the market that are driven by a lack of VC investment. Logically, the only reason to build your own software capabilities is if you can't get a better and cheaper solution to your problem in the market. Historically, these homegrown solutions are great to start with (if there isn’t a great alternative in the market) but with time become expensive and lack the scale and superiority of a solution built by a dedicated software company. Imagine if pharma built their own cloud vs using Google Cloud/AWS/Azure.

An interesting fact is that investors believe that the ELN market is actually double in size if you take into account the amount of money that pharma spends on building internal solutions that are now obsolete. - Buyers beware - while billions of dollars have been invested in AI and drug discovery startups, the majority of them will not survive. The current financial environment is accelerating this. We are already starting to see consolidation in the AI biotech vertical as a result of companies’ inability to fundraise. Having just gone through an intense fundraising process I predict that more startups in the SaaS AI market will go under. My recommendation is for pharma buyers to ask for access to the financials of AI software companies and vendors before working with them. You want to avoid being in a position in which your AI vendor of choice goes out of business while having access to your data.